March 2021 Market Reap and Outlook

Bitcoin (BTC) – Monthy Recap

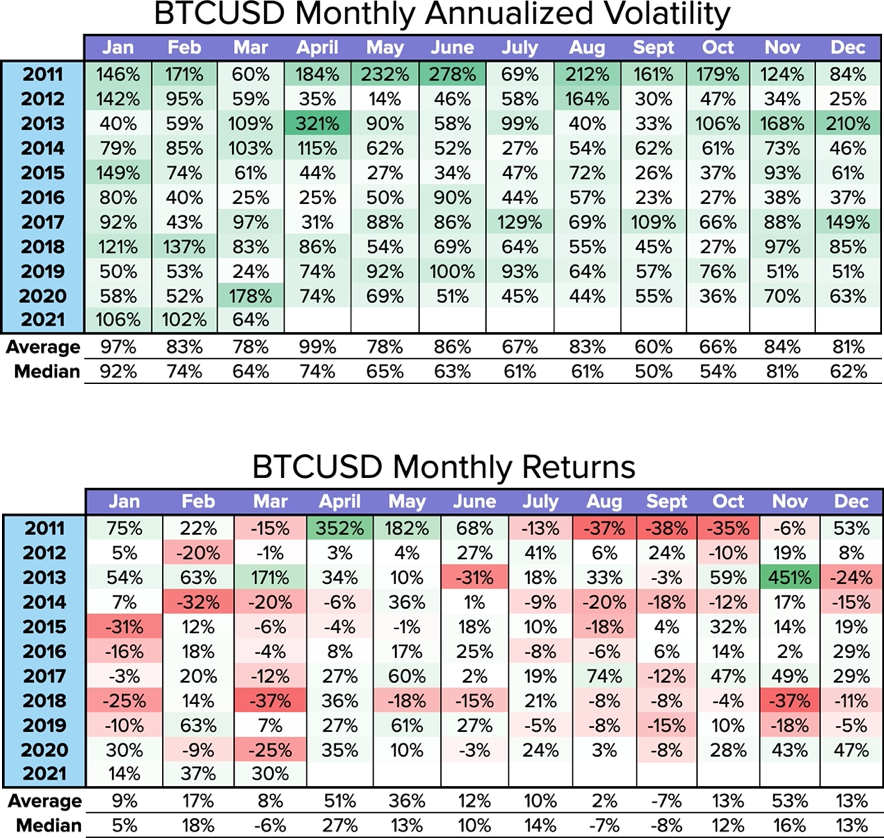

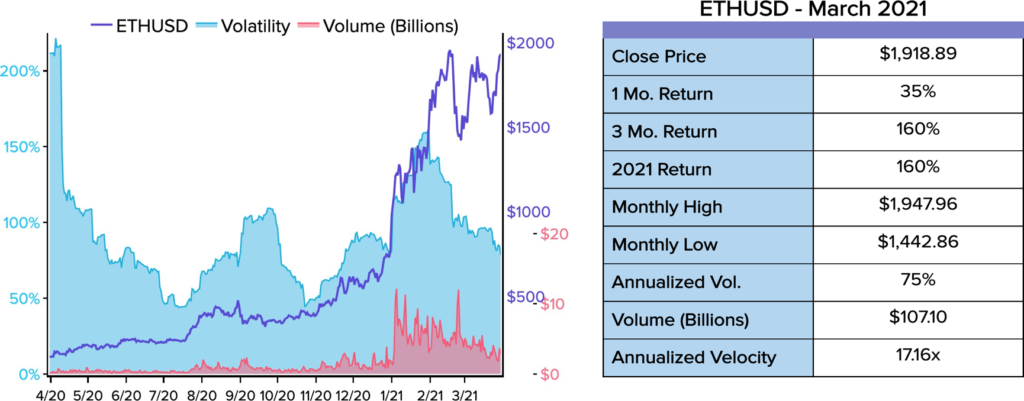

- BTC finished Mar. up +30%, which marked a sixthconsecutive month of double-digit, positivereturns. With Apr. being, on average, the secondbest performing month, one could expect BTC tofinish higher and thus tie for the longest winningstreak since BTC’s inception.

- Further interest and excitement surrounding NFTsattracted considerable attention from new and existingmarket participants, thereby driving the broader NFTspace +285% higher in Mar. Of the 10 largest NFT coinsby market cap, Mar.’s average and median returnswere +404% and +343%, respectively. Aggregatedaily transaction volume across the largest NFTmarketplaces also hit an all-time high of $34M on Mar.11.

- Corporate adoption, institutional adoption, the passing of a$1.9T COVID-19 relief package in the U.S., and several

- The current trend in BTC’s bull market support, the 20WEMA and the 21W SMA, suggests that one could expectBTC’s bull market support to reside around $44,165and$48,702 come May 1. At a month-end price of $58,786, thiswould mean that a retrace down to said support would gofrom -29% to -36% to roughly -17% to -25%.

- Despite setting a new all-time high of $61,725 andsubsequently correcting -18.5%, BTC finished Mar.+30% higher and secured a sixth consecutive monthof positive returns.

- BTC’s steady uptrend resulted in volatility falling nearly-40 percentage points MoM and finishing the month at63%, a near 3-month low. The lack of market volatilityresulted in trading volumes falling -5% and hitting a YTDlow of roughly $255B.

- Mar.’s annualized velocity of 9.43x came in wellbelow Feb.’s reading of 10.9x and marked a 4-yearlow. The slump in velocity tells us that network activitywas relatively timid and failed to keep pace with BTC’sappreciation.

Ethereum (ETH) -Monthly Recap

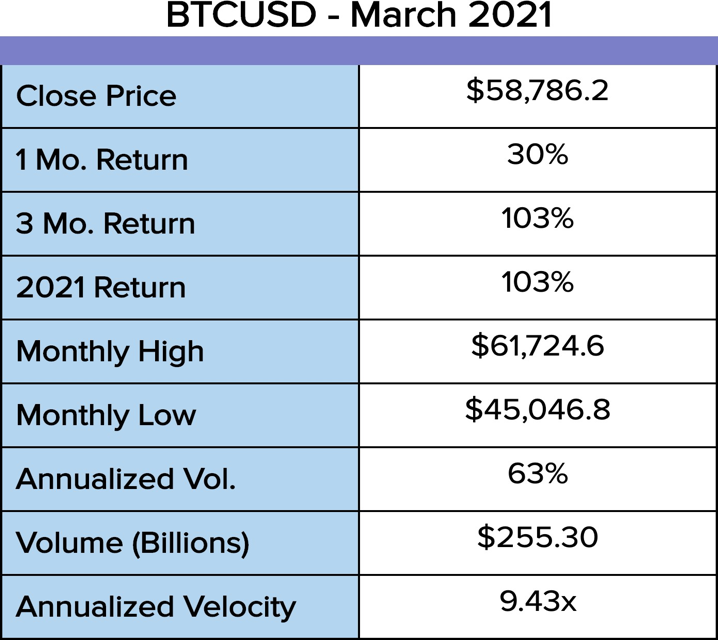

- After a relatively underwhelming +9% return in Feb.,ETH outperformed BTC with a noteworthy +35% returnin Mar. Unlike BTC, ETH failed to secure a new all-timehigh and fell short of surpassing the psychologicallysignificant $2,000 level.

- Mar. marked a third consecutive month of decliningmarket volatility and trading volumes; the monthconcluded with both hitting a YTD low and falling -23percentage points and -31% MoM, respectively.

- Earlier in the month, Vitalik Buterin said that layer-tworollups solutions could scale Ethereum’s network by100x “in the next few months.” News also broke thatEIP-1559 is officially set for July’s London hard fork;the EIP means that ETH’s inflation could potentially hit0% or even turn negative.

What Happened in Crypto?

- Mar. 1: MicroStrategy buys $15M of BTC, Japanese e-commerce giantRakuten enables support for crypto purchases, CBOE files with the SEC to listshares of VanEck’s BTC ETF, Goldman Sachs says it’s launching a cryptotrading desk.

- Mar 5: MicroStrategy buys $10M of BTC.

- Mar. 6: The U.S. Senate passes President Biden’s $1.9T COVID-19 reliefpackage.

- Mar. 7: Publicly-listed selfie app Meitu buys $40M worth of BTC and ETH.

- Mar. 8: BTC mining firm Argo Blockchain purchases 320 acres of land inTexas for a 200MW data center; PayPal purchases digital asset security firmCurv.

- Mar. 9: JPMorgan regulatory filings reveal a ‘basket’ product tied tocrypto-linked public companies, Norwegian oil billionaire Kjell Rokeepurchases $58M worth of BTC.

- Mar. 10: DCG says they will buy $250M of GBTC shares, the percentageof BTC’s supply on exchanges hits a 37-month low of ~13%, and the U.S.House approves a $1.9T relief bill.

- Mar. 11: WisdomTree files for a BTC ETF, cryptoasset manager CoinSharesgoes public in Sweden.

- Mar. 12: MicroStrategy buys $15M worth of BTC, Binance is probed by theCFTC.

- Mar. 19: Brazil becomes the first LatAm country to get its first BTC ETF, FATFreleases public consultation for its updated draft guidance on a risk-basedapproach to virtual assets and VASPs.

- Mar. 22: Fed’s Powell says BTC is more of a substitute for releases an assurance report that shows its stablecoins were fully backed, Dapper Labs raises$305M in a new round of funding.

What Happened in the Traditional Markets?

- United States: The ISM manufacturing survey hit its highest readingsince 2008, marking 9 consecutive readings above the key 50 break-even level. The ISM services survey came in below expectations, butremained in “expansion” territory (> 50). Unemployment fell -0.1percentage points to 6.2%. CPI (inflation) rose +0.4%, the ProducerPrice Index (PPI) gained +0.5%, NFIB’s Small Business Optimismsurvey showed a net 34% of businesses plan to raise prices nextquarter, and the National Association of Realtors noted that themedian home price rose +16% YoY. The FOMC met and left rates unchanged, but revised upward its GDP and inflation forecasts for2021.

- China: China’s financial regulator said that asset bubbles exist inglobal asset markets as well as in local property markets, whichweighed on equities. China’s manufacturing index fell for a second consecutive month, but remained in expansion territory, while itsservices index sank to a 10-month low. China’s National People’sCongress (NPC) rose its target GDP growth rate to +6% for 2021 andstated a need to reduce leverage over time.

- Europe: Eurozone retail sales fell -5.9% MoM vs. an estimated decline of -1.4%. The ECB said it plans to significantly increase the pace of its bond purchases in the months ahead. A recent global shortage of semiconductors led the EU to unveil a €150B investment into domestically produced semiconductors in a bid to make up 20% of global capacity.

- Global Markets: Global equities finished mostly higher thanks to therollout of Biden’s $1.9T COVID financial relief bill, increasedoptimism surrounding the future growth of the U.S. and European economy, and ongoing negotiations surrounding Biden’s $2Tinfrastructure proposal. Global bond yields also rose on growingconcerns of inflation and a greater global economic outlook asCOVID-19 infections dwindled.

BTC Correlations

- A rotation out of growth stocks and large cap tech stocks resulted in BTC’scorrelation with the Nasdaq (-0.09) and Tesla (-0.72) turning negative for the firsttime since Jan. 2020. This shift showed that BTC is currently not trending withexposure to large cap tech stocks.

- BTC’s correlation with the S&P 500 (0.80) and Stoxx 600 (0.87) was littlechanged MoM. Until stocks retreat from current all-time highs, it remainsunclear whether a broader rotation out of traditional “risk- on” assets will spillover into BTC. For example, in Sept. 2020, the S&P 500 entered into a -10%correction after hitting an all-time high of 3,588, thereby causing BTC to fall-37% in the first week of September.

- BTC’s correlation with the U.S. Dollar Index (DXY) strengthened further inMar. and finished at a 1-year high of 0.68. The reversal can be attributed to theU.S. dollar scaling to a near 5-month high and posting its best month since Nov.2016 amid higher stimulus-induced bond yields and upwardly revisedforecasts for economic growth. Should demand for U.S. dollars hold up onlingering expectations of a stronger U.S. economy and a long overdue reliefrally, BTC could face near-term headwinds.

- Given that BTC posted its third best 1Q (+103%) in history and gold faced its worst 1Q (-10%) in 39 years, it comes as no surprise that BTC’scorrelation with gold (-0.83) turned negative yet again. As a matter of fact, lastmonth’s correlation marked a 52-month low.