Bitcoin is hard-coded to decrease block rewards for mining by half every 210,000 blocks, a phenomenon called the Bitcoin halving. The block reward, part of the PoW(Proof of Work) consensus, is the number of bitcoins a miner receives when successfully mining a block of bitcoin.

The current block reward is 12.5 bitcoins and will decrease to 6.25 bitcoins in May 2020. The halvings will occur until the maximum 21 million supply of bitcoin will be mined, out of which 18.2 million have already been mined.

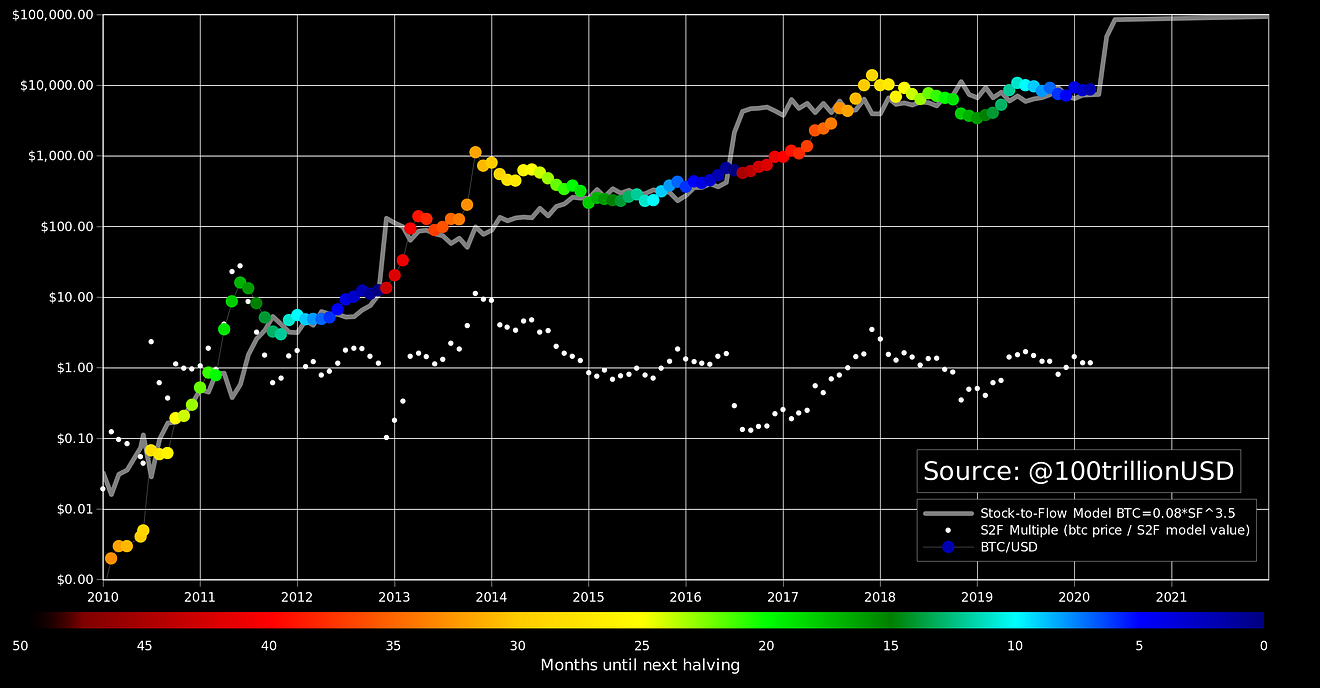

The decreased mining rewards will increase bitcoin’s digital scarcity, as shown by the stock-to-flow(S2F) model, graphed in Figure 5. The S2F model is considered to be a bitcoin valuation model based on the stock-to-flow ratio.

What is Stock-to-Flow Model?

The stock-to-flow ratio measures the flow of new supply produced by bitcoin miners in relation to the outstanding stock of bitcoin – showing the number of years required, at the current production rate, to achieve the total supply.

In May 2020 the S2F ratio will double, to 50, thus increasing the scarcity of bitcoin. According to the model, Bitcoin’s price should reach 100,000 $ due to this increased scarcity. The model has been accurately predicting bitcoin’s price, with an R2 correlation of 95% [4].

Furthermore, the model also has a high correlation when testing it against gold and silver. As bitcoin’s stock-to-flow ratio increases to 50, it gets closer to Gold’s stock-to-flow ratio of 62. This indicates that Bitcoin’s market cap should move towards gold’s market cap.

Previously, increased digital scarcity has led to Bitcoin reaching new highs. This can be seen in figure 5, where the halving is represented by the shift of dark blue dots, to dark red. This is because miners are forced to sell their mined bitcoins to cover their costs, creating a constant selling pressure on the market.

Starting from May 2020, they will only be able to sell half of what they previously could. Specifically, they currently sell an approximate of $400 million per month, which will halve after May’s halving. Assuming that demand remains the same, this will tip the scales relative to supply and demand and cause a surge in bitcoin’s price.

Gold 2.0

Bitcoin is often referred to as Digital Gold. Gold has proven to be a store of value and Bitcoin is increasingly being considered as one.

For now, trust in Bitcoin is larger than the one in gold. This is because it is exactly known how many bitcoins are in existence and how the inflationary rate will evolve in the future. As of gold, nobody knows exactly the amount of gold mined, the size of global natural gold reserves and the future production rate. However, gold has proven itself as a store of value for thousands of years, which bitcoin has not. In time, blockchain technology will have the opportunity to prove itself.

In terms of portability, bitcoin is not a physical asset. Therefore one bitcoin can be divided as one sees fit. On the other hand, it is insecure to make large gold payments and it is hard to divide it into the equivalent of small sums which you need for daily activities. Furthermore, bitcoin’s transactions are immutable and private.

The barriers of entry and exit are smaller when entering crypto-assets in comparison to gold. You are not required to purchase any minimum amount and you are able to sell it whenever you want with very low fees of doing so.

The largest difference between bitcoin and gold is decentralization. Bitcoin is not governed by any central bank or government body.